ISO 14097 For Climate Finance - Why It Matters?

Introduction

Banks, asset managers and development finance institutions are under pressure to show whether their portfolios help or hinder climate goals. They issue green bonds, fund transition projects and publish climate reports, yet still struggle to prove if their money really supports a low-carbon, climate-resilient economy or just re-labels business as usual. ISO 14097 applies to investors and lenders and covers three big questions: how well portfolios line up with climate pathways, what impact financing has on mitigation and adaptation in the real economy and what climate risks sit on the balance sheet.

If your institution wants to structure climate finance decisions or review readiness for ISO 14097-aligned assessment and reporting, you can request an audit plan from Pacific Certifications to discuss scope, timelines and evidence needs.

Quick summary

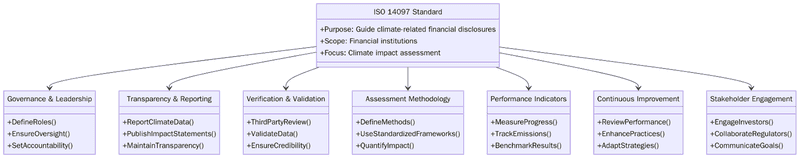

ISO 14097 sets out a framework for climate finance by asking institutions to define climate objectives, select suitable metrics and targets, use scenarios, assess risks and document methods and results. It helps investors and lenders show how their portfolios align with climate pathways, how financing affects mitigation and adaptation and how climate risks may influence financial performance.

Why ISO 14097 matters for climate finance?

Climate finance has grown quickly through green bonds, sustainability-linked instruments and climate funds, but methods for judging climate alignment still vary widely. Some institutions focus on carbon footprint, others use scenario analysis and many rely on in-house methods that are hard to compare.

For portfolio managers, it links investment decisions with climate pathways, risk and performance indicators. For risk teams, it creates a structure for climate-related risk analysis. For supervisors and clients, it gives a way to read climate claims against a recognised framework instead of a patchwork of disclosures.

What are the requirements for ISO 14097?

ISO 14097 is a framework standard, but it contains clear principles and requirements that function like a checklist for climate finance governance. Key expectations include:

- Define the scope of application: asset classes, portfolios, business lines and entities covered by ISO 14097-based assessment and reporting.

- Identify climate-related objectives, such as portfolio alignment with specific temperature goals, sector pathways or adaptation outcomes.

- Analyse relevant internal and external context, including climate policy, sector trends, data availability and existing risk frameworks.

- Map climate-related risks and opportunities for the covered portfolios, considering transition and physical risk channels.

- Select metrics and indicators that reflect both alignment and impact, for example financed emissions, implied temperature rise, exposure to sensitive sectors or share of climate-relevant assets.

Tip:start with a simple matrix that links each climate objective (for example Paris alignment or physical risk resilience) to the metrics, tools and decisions used in that area.

How to prepare for ISO 14097 implementation?

Getting ready for ISO 14097 is about joining up climate strategy, risk, portfolio management and disclosure. Refer to the points below:

- Run a climate finance gap analysis comparing current practices with the core elements of ISO 14097: objectives, metrics, targets, scenario use and reporting.

- Build a portfolio map that shows which assets are in scope, which sectors matter most for climate impact and where data is weakest.

- Agree climate objectives at leadership level, including how they relate to existing net-zero or transition plans.

- Select a manageable set of metrics that link portfolios to climate goals and risk and assign ownership for each metric.

- Choose scenario tools and pathways that will be used for alignment and risk analysis and document why they are appropriate for your context.

- Integrate climate analysis into investment and credit processes so that climate metrics influence decisions rather than just sitting in a report.

Certification audit

Stage 1 audit: Review of ISO 14097 scope, climate objectives, portfolio coverage, metrics and targets, scenario and data choices, high-level methods and internal governance.

Stage 2 audit: Verification of implementation across selected portfolios, including how climate metrics influence decisions, how results are monitored, how documentation is maintained and how disclosures reflect the framework.

Nonconformities: Must be corrected with clear root cause analysis, updated methods or controls, improved records and evidence that the new approach is in use.

Surveillance audits: Conducted annually to confirm that ISO 14097 processes, metrics, portfolio coverage and disclosures remain in place as markets and rules change.

Recertification audits: Required every three years to review the full framework, including new products, asset classes, data sources and climate policy developments.

What are the benefits of ISO 14097?

ISO 14097 helps climate finance move from scattered tools to a single, structured approach that links money flows and climate outcomes. Below are key benefits:

1. Clear connection between climate goals and portfolio decisions, supported by defined objectives, metrics and targets.

2. Better insight into how financing supports or conflicts with low-carbon and adaptation pathways at sector and portfolio level.

3. More consistent use of scenarios and metrics across teams, which improves internal coordination and comparability of results.

4. Stronger climate-related risk analysis, as transition and physical risks are assessed within a shared framework instead of separate methods.

5. More credible climate disclosures for clients, investors and supervisors, based on a recognised international standard.

Market Trends

Climate finance is moving from product-level labels to portfolio-wide accountability. Investors and lenders are expected to show how their whole balance sheet lines up with climate goals and how their actions influence emissions and resilience in the real economy. At the same time, green bonds, sustainability-linked bonds and other labelled instruments keep growing and draw more attention to climate performance and use of proceeds.

Data and tools are also changing quickly. New platforms provide financed-emissions data, sector pathways and portfolio alignment metrics. Academic work on green instruments, climate risk and bond markets is feeding into risk models and pricing. As climate rules tighten and expectations on disclosure rise, standards like ISO 14097 are likely to become reference points for institutional investors, banks and public finance bodies that want climate claims to be backed by traceable methods and repeatable assessments.

Training and courses

Pacific Certifications support financial institutions working with climate finance and ISO 14097 through:

- Lead Auditor Training: for professionals who need to review climate finance frameworks, metrics, methods and reporting.

- Lead Implementer Training: for teams building ISO 14097-aligned approaches across portfolios, credit processes and disclosure teams.

If your institution needs ISO 14097-related training tailored to its portfolios and climate goals, contact [email protected].

How Pacific Certifications can help?

Pacific Certifications provides accredited audit and certification services for management system and climate-related frameworks and can assess institutions that align their climate finance governance with ISO 14097. Our audits review scope, objectives, metrics, portfolio coverage, methods, data sources, scenario use, documentation, internal audits and management review.

To request an ISO 14097 audit plan or discuss climate finance certification for your institution, contact [email protected] or visit www.pacificcert.com.

Ready to get ISO 14097 certified?

Contact Pacific Certifications to begin your certification journey today!

Author: Alina Ansari

Suggested Certifications –

Read more: Pacific Blogs